Automated Identity Verification for

Digital Finance

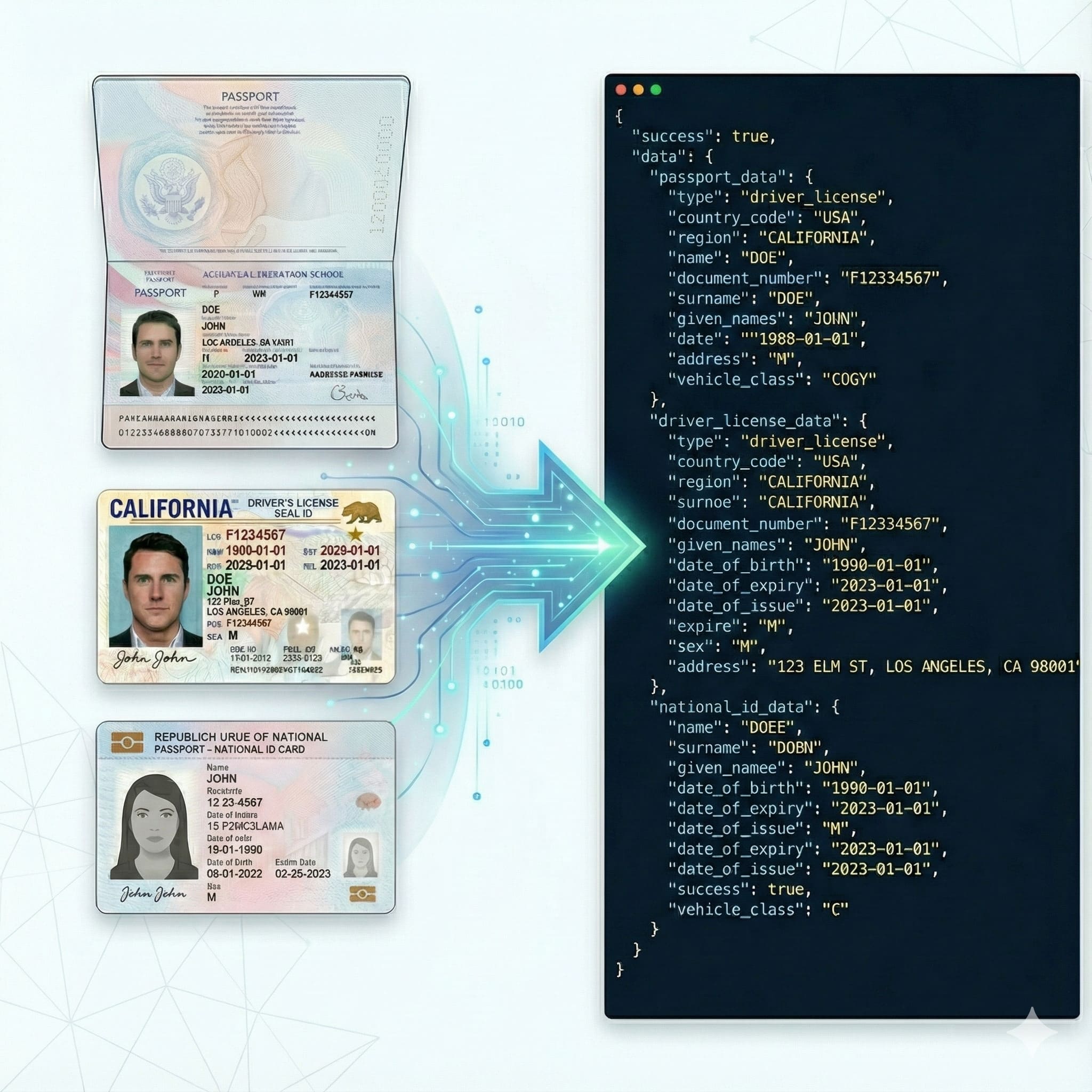

Accelerate customer onboarding and automate KYC workflows. Instantly extract structured data from Passports, Driver Licenses, and IDs to reduce fraud and manual review costs.

Built for Secure Financial Workflows

Bank-Grade Compliance

Meet strict AML and KYC requirements. We extract every critical field needed for due diligence, including document numbers, expiry dates, and full names.

Frictionless Onboarding

Reduce drop-off rates by 40%. Allow users to scan their ID instead of typing, turning a tedious 5-minute form into a 5-second experience.

Zero-Retention Privacy

Your data security is paramount. We process documents in-memory and return JSON immediately. No images are ever stored on our servers.

Powering the Future of Finance

From traditional banking to Web3 exchanges, our OCR API provides the infrastructure to scale user acquisition securely.

Neobank Account Opening

Automate identity verification for new users directly in your mobile app, enabling instant account activation without manual back-office review.

Cross-Border Remittance

Ensure sender and receiver legitimacy by validating Passports and IDs instantly, meeting international money transfer regulations.

Loan & Credit Application

Speed up credit approvals by automatically extracting data from National IDs and driving licenses to pre-fill application forms accurately.

Global Coverage for KYC & AML

Scaling globally requires handling thousands of different ID formats. Our structured OCR API normalizes data from 200+ countries into a single, clean JSON format, regardless of the document type.

- National ID Cards: Front & back extraction for domestic KYC.

- Passports: MRZ code parsing + visual zone text extraction.

- Driver Licenses: Address and license class verification.

Maximize Efficiency, Minimize Risk

Cut Operational Costs by 90%

Manual KYC review is slow and expensive. Replace human data entry teams with automated API calls, allowing your compliance team to focus only on flagged high-risk cases.

Eliminate Data Entry Errors

Typos in names or ID numbers cause failed background checks and lost customers. Our high-fidelity OCR ensures data is captured exactly as it appears on the document.

Standardized Data Output

Stop wrestling with messy data. Whether it's a French Passport or a California Driver License, you get a consistent JSON structure ready for your database.

PayStream

Reduced user onboarding time from 2 days to 30 seconds.

By integrating StructOCR for their merchant wallet verification, PayStream automated 95% of their KYC checks, allowing them to scale to 100k users without hiring more support staff.

"In Fintech, accuracy is non-negotiable. StructOCR delivers the structured data we need for AML checks faster than any other provider we tested."

Precise Data Extraction and Seamless

Integration with AI-powered OCR API.

Empower your solutions with automated data extraction by

integrating best-in class StructOCR via API seamlessly.

No credit card required • Full API access included